Previous 770 APPROVED Opportunity Allocations

D-WAVE QUANTUM INC.

Canadas most disruptive quantum computer technology. with over 1000qbits.

We have been following this company since 2016.

They were selling Warrants back in the day where we didn’t buy. But after their patents took off and more exposure with the government of Canada.

in 2025 they became public. At a share price of under 1$ CAD. It was a clear signal to buy. Within a month or two it started getting hype and announcements. With the mainstream talking about AI and quantum computers and processors. The activity of the trading increased.

-It was 770 APPROVED in the early days and at the start of the public start. 1$/ share and currently trading at over 21$ a share and a high of over 40$.-

OHB SE

This Space company is the heart of the German / Swedish space company. They have been building satellites and space structures. Like parts for rovers, rockets and consultings. Been in the industry for over 30 years. The company holding 90% for all the shares of the company. A powerful family. Tightly held company but international relationships.

-It was 770 APPROVED back in 2020 at 20$ Euros. And today it is valued at over 110$ Euros. With lots to come in the near future.-

OKLO INC.

I call this one “a new energy stock”.

During the first months of this company launching and inking major department of defence / USA National Research Lab testing and partnership for their nuclear power patent.

Multiple partnerships and initial exposure to green tape motions. Low market cap for its sector. Has been 770 APPROVED when it first came out in 2025. In April at 22$/ share.

XRP / RIPPLE LABS INC.

The XRP blockchain and entity. Became public for the purpose to transfer money at a fraction of the cost. Within seconds and instantly and at a very cheap fee. A goal for cross border payment systems. For efficiency and security and low low fee.

Partnerships with many international companies and banks. Still forming relationships.

The SEC battle trying to regulate crypto markets resulted in the company share price falling. And rebounding after then end of the SEC lawsuit.

-Was 770 APPROVED in the 0.30$ CAD activity Price. And timing is everything when it comes to volatility.-

ExactEarth LTD.

This start up company who had early partnership access with the Canadian Space Agency. The business plan was simple. Create a new Maritime supply ship/ cargo ship live imageries on the global scale. Tracking information as well. ExactEarth during the day lost its share price because of the declined Bank Line of credit agreement being rejected. From a public start launching at 2.5$ a share to news like that dropping to .20$ a share over 85% in a single day. But with plans and dedication inking a partnership deal for IP transferring with Spire Global by rewarding us shareholders to over 2.5$/ share. Benefiting every shareholder since the 4 year public.

-It was 770 APPROVED at 0.25$ share price to the acquisition.-

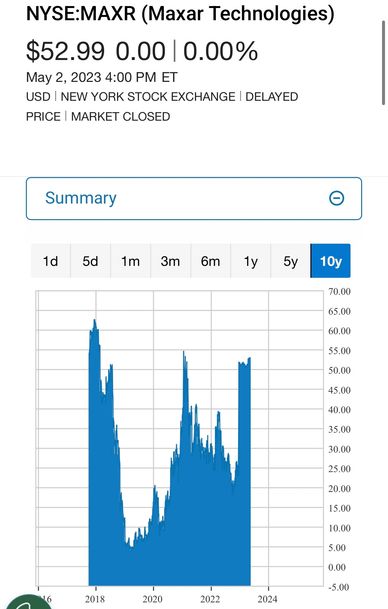

Maxar Technologies

During 2016 days. The company MAXAR that held multiple companies including MDA, SSL, and other satellite makers. Were held under this entity.

Unfortunately losing lots of cash flow from the failed SSL company. Resulting in a big sell off dropping the share price to under 3$. During that low time an opportunity. Reorganizing its business and eventually selling MDA for 1billion $ in 2020. Creating Maxars big share/ market cap value to increase right before 2020 announcement. Finalizing then MAXAR now becoming a defense contractor for robotic satellites. Concluding MAXAR share price to 53$.

-It was 770 APPROVED at 3$/share back in 2019-

Telesat Communications Ltd.

This spin off of broadband internet around the globe.

A competitor of Starlink. It create high value when the govt. if Canada backed out of the Elon musk deal. Telesat created partnerships with Canada and the UK. With them owning equity in the company itself. Deals with MDA SPACE and taxpayer money being put in has been a good investment company.

This was 770 APPROVED when it dropped to 7.80$ a share and has been creating value since 2024..

Research and capabilities is everything when it comes to market value.

UGE INTERNATIONAL

UGE was a renewal energy company. Their solar panels technology and installation is what they do. In the early days the govt. of Canada invested in the company for the purpose to leverage the company for contracts supporting many warehouses and native communities.

UGE at the time was a perfect opportunity to invest in. Its share price was low and undervalued. With future developments still being done within the company. Always helps the investor support within the public trust.

-It was 770 APPROVED back in 2018 .16$ and then the takeover to private at a share price of 2$ a share.-

Canopy Growth Corp

When Canopy first became tweed parent company. They cross listed on the Canadian stock exchange. With the business plan of turning medical cannabis to a recreational cannabis company. During the time of potential legalization planifications. With deals and partnerships to form a good investment opportunity.

-It was 770 APPROVED at early 2016 date.-

RBC BANK

RBC BANK

The best bank of Canada. Has been 770 APPROVED when they bought HSBC. Was the biggest takeover in Canada’s history. 2022 announcement. The biggest bank who converts the most currencies around the world.

Strong dividends company and great looking graph long term. Stable and steady is always good for low risk but stable gains.

Copyright © 2025 770 Venture Capital Ltd. - All Rights Reserved.